The rise of the Bro-Block Portfolio

You might know an acquaintance or friend of a friend who has done hilariously well taking significant risks in the stock market and crypto over the last few years.

Diving into this phenomenon, I’m calling it the Bro-Block Portfolio.

Rise of Individual Investing

COVID

Short Run

Crypto

What to do

"All things are poison, and nothing is without poison; the dosage alone makes it so a thing is not a poison." - Paracelsus

Rise of individual investing

Brokerage companies (Fidelity, Schwab, etc.) used to charge $5-10 per trade in the 2000s. They dropped their trading fees to zero because of the competition from Robinhood and Betterment, who offered “free” trading.1

Free trading allowed smaller investors to start actively trading more. If you’re trading $10,000, $10 trades tend to add up quickly.

Free trading and easier-to-use phone apps created an environment ripe for a catalyst to spark the explosion in individual investing.

That catalyst was COVID.

COVID

Everyone was sitting around at home, unable to do anything. The combination of fiscal stimulus (the stimmy checks) and monetary support (the Federal Reserve ensuring no end to liquidity) created the perfect conditions for significant stock market gains after the initial crash.

Instead of gambling, men, and yes, it’s almost always men, started taking significant risks in the stock market.

And it worked for some of them.

There are plenty of examples of people who rolled options on Tesla, Gamestop, AMC, and other companies that temporarily went parabolic; this era was labeled the meme-stock phase.

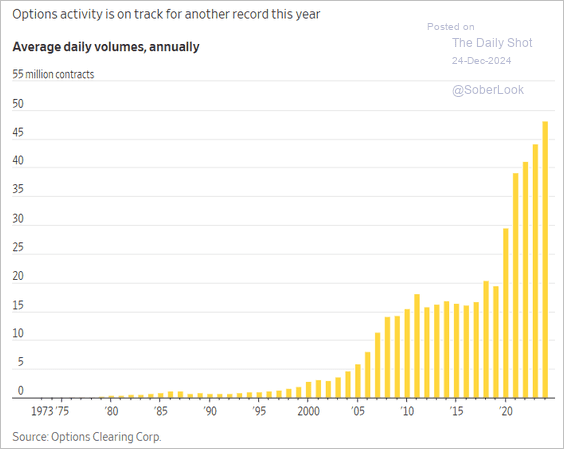

The explosion can be seen in the increased risk-taking in options trading:

Extreme risk-taking and taking significant positions can work out in the short run. The market can misprice assets for an extended period, but ultimately, the price tends to arc closer to the true value.

AMC is an excellent example of this because it was part of the meme-stock phase. It was a struggling business before COVID since movie theaters are slowly dying.

The meme-stock craze propelled AMC to a valuation of over $30B and a price-to-earnings ratio of over 450x (the average market PE ratio is ~20x).

Over time, the valuation and price of AMC fell 98%:2

The value is now sitting at ~$1B. If you gambled in the short-term and got out, then fantastic. If you stayed in the stock, then whoops!

Speculation gets more complicated when there is no empirical valuation for the underlying asset.

Enter Crypto

In traditional investing, you examine a company’s fundamentals (earnings, cash flow, expected growth, etc.) and say, “I think it’s worth this much, and at its current price, it’s a buy or sell.”

In crypto land, there are no traditional metrics.

There are stories. For humans, stories are more powerful than any boring traditional investing metric.

That’s what crypto and bitcoin, particularly, have—a great story.

Bitcoin is decentralized, not controlled by a government, and has a fixed supply. This story feeds into people’s perception that it’s anti-establishment, a hedge against inflation, and other narratives.

The fact that crypto is increasing in value continues to embolden support.

Also, crypto combined with risk-taking in meme stocks have beaten a traditional portfolio in 2024:

The simplest explanation for the cryptocurrency recovery is that it is a significant asset class within the speculative economy. People who like to bet on things like to bet on cryptocurrencies.3

This thinking is called the greater fool theory of investing. Sometimes, you’re hoping for someone else to come along and buy your speculative asset. Maybe it happens, and perhaps it doesn’t.

A fantastic example of this is Fartcoin.

Its market cap is $1.2B (close to AMC’s), and its growth rate has been +2,800% over the past year.4

When I learned about this, I honestly had to scoff at the pure speculation involved in investing in something like Fartcoin—like CMON, people.

But, hey, this is where we are in the risk-taking cycle—fart jokes turning into gold for some people.

Other real assets in the economy are surging in price. However, they lack the narrative storytelling to grab attention in our meme-internet world.

Cocoa comes to mind. It’s performing stronger than Bitcoin:

Look at this parabolic move over history:

Cocoa arguably has more real-world implications than Bitcoin, but you probably haven’t heard about the surge in its price because it’s not as interesting.

What to do

It seems that crypto and certain forms of speculation are not going away soon.

If you feel you’ll experience FOMO, invest 1-3% in what you consider legitimate enterprises for the future: maybe not Fartcoin, but some other coin. You should commit to holding it for some time because these assets can and will go down; Bitcoin went down 75% in 2022.5

So, if you’re going to speculate invest in crypto, you need to commit to the ride.

DISCLOSURE

The information presented is solely for informational purposes. The information, statements, comments, views, and opinions expressed in this podcast and newsletter do not constitute and should not be construed as an offer to buy or sell securities or make or consider any investment or course of action. The views or opinions expressed in the podcast and newsletter are the author's views and do not reflect the opinions and beliefs of the podcast and newsletter, its affiliates, the author’s employer, or any other person. The podcast and newsletter do not undertake any duty to publicly or otherwise update or revise any disseminated information.

Me on my deathbed:

The Intelligent Investor is a book made famous by Warren Buffett. The book is the foundation for Buffett’s investing and outlines how to value companies. It is the antithesis of something like crypto.

Nothing is ever “free.” Companies now direct their orders to market makers who pay the brokerage companies for the right to execute orders. There are many theoretical arguments about the true cost of this, but to say trading is free neglects that there are other implicit costs to having a market maker involved in your trade execution.

Have you heard of Citadel (owned by wealthy dude Ken Griffin)? Well, they’re a market maker; they’re not getting hilariously rich for free.

Here is a fantastic thought from Howard Marks on how to think about market efficiency:

in reality, markets are not efficient in the academic sense of always being “right.” Markets may do an efficient job of (a) rapidly incorporating new information and (b) accurately reflecting the resulting consensus opinion concerning the right price for each asset given the totality of information, but that opinion can be far from correct.

From Coinbase

According to Koyfin