Inflation numbers came out yesterday at 7.5% and everyone is comparing it to the 1970s and “The Great Inflation”.1

I might not have been alive in the ‘70s. But quick! Jump into my time machine for a nerdy history lesson!

What the heck happened back in the 1970s?! A few big things:

Nixon takes the US off the Gold Standard

1973 Oil Embargo

1978 Iranian Revolution

Stagflation

Nixon

In 1971, that pesky crook did a great thing by taking the US off the gold standard. Before this you could convert $35 to one ounce of gold. Going off the gold standard created what is called “fiat” currency. Money backed by nothing more than the “full faith and credit” of Uncle Sam—And, oh yeah, the US military.

This allowed prices to fluctuate and reset to where they should’ve been.

1973 Oil Embargo

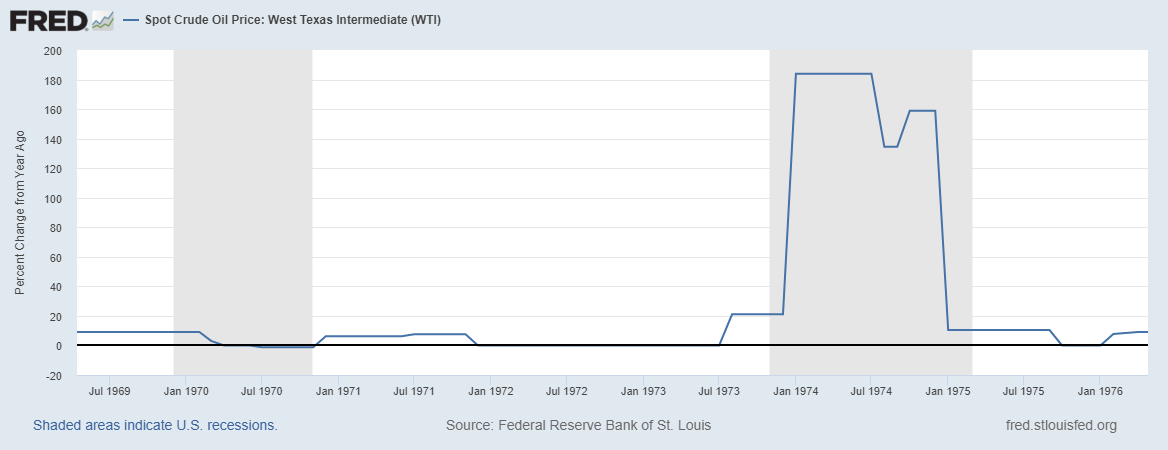

The good ol’ US helped out Israel when they were in a bind during the Yom Kippur War. Israel was fighting several Arabian states led by mainly Egypt and Syria. OPEC (Organization of Petroleum Exporting Countries, which is a conglomerate of Arabian states) did not take kindly to our help and cut off US imports of oil. And oil went bananas…from $3.5 per barrel to over $11:

On a percentage basis that is multiple years of oil increasing at 100%:

On top of this, there was a large drought affecting other commodities. One example is from the Guardian:

“The 1973 wheat crisis followed a 1972 drought that destroyed 20% of the Soviet Union's food crops.

It prompted Moscow to buy up all US wheat reserves. The move became known in the City as "the great grain robbery''23

Those factors started inflation slowly grinding higher (as measured by CPI):

1978 Iranian Revolution

Just as consumers were recovering from the Oil Embargo…Boom! The Iranian Revolution occurs and cuts their oil output, which at the time was 7% of world production.4

Then a similar story plays out oil pops from $15 a barrel to $40 and inflation rises:

Stagflation

What people remember from this time is summed up by the term Stagflation. A stagnant (not growing) economy and inflation. That is shown below as Real (adjusted for inflation) GDP (a proxy for economic growth) is in blue and inflation is in red:

Stagflation frankly sucks— the economy was contracting/not growing and prices are rising. That sucky feeling is what the Boomer generation remembers and fears.

The composition of the 1970’s inflation is important to understand current implications.

Inflation in 1973 was mainly driven by the end of price controls and energy prices. Those two factors made up ~60% of the increase in inflation.

1978 inflation was similar as energy prices made up ~40% of the increase.5

Some people point to Fiscal spending or printing money during the 70s’ as the main culprit. That’s not really what happened. The Federal government’s spending did not change too much compared to its before the increase in inflation. Federal spending is in red (you can see it’s pretty consistent before higher inflation occurs):

Bringing it back to the present

The factors that led to The Great Inflation are what economists call “supply shocks”6 . Supply got all whacky for a variety of reasons and it led to a self-fulfilling cycle of higher prices.

Presently, we are going through our unique supply shock with COVID (I wrote about that here: COVID Consumer Spending). But for us to have similar sustained inflation we would need oil to start doubling. Here we are meow:

If your thesis is that we will get The Great Inflation again, then you need oil to hit $160 per barrel and then promptly double again.

Yes, oil is grinding higher now as it’s up ~20% annualized (a far cry from 100%):

As oil prices rise then more US shale producers will most likely come online. That is a huge difference going on today as the US is the largest producer of oil.78

Also, despite the inflation, we are getting strong GDP growth at 5.5%.9 That would currently rule out stagnation.

My two cents (it ain’t worth much)

I bet we are at peak inflation as of the current 7.5%, but it’s not going back to 2%. Because of other inflation factors in services and rent, we are going to stay elevated around 4% for the next year or two.

Can’t wait to find out how I’m wrong!

https://www.federalreservehistory.org/time-period/great-inflation

https://www.theguardian.com/world/2010/aug/08/russia-wheat-prices-bread

https://www.brookings.edu/wp-content/uploads/1975/12/1975c_bpea_cooper_lawrence_bosworth_houthakker.pdf

https://www.federalreservehistory.org/essays/oil-shock-of-1978-79

https://www.nber.org/system/files/chapters/c9160/c9160.pdf

https://www.nber.org/system/files/chapters/c9160/c9160.pdf

https://www.eia.gov/tools/faqs/faq.php?id=709&t=6

Great visual of oil production by country: https://www.aei.org/carpe-diem/chart-worlds-top-ten-oil-producing-countries-1965-to-2018/

https://www.wsj.com/articles/us-economy-bounced-back-q4-gdp-11643235508