Inflation and the Federal Reserve (the Fed) are as one philosopher, Mugatu, put it are:

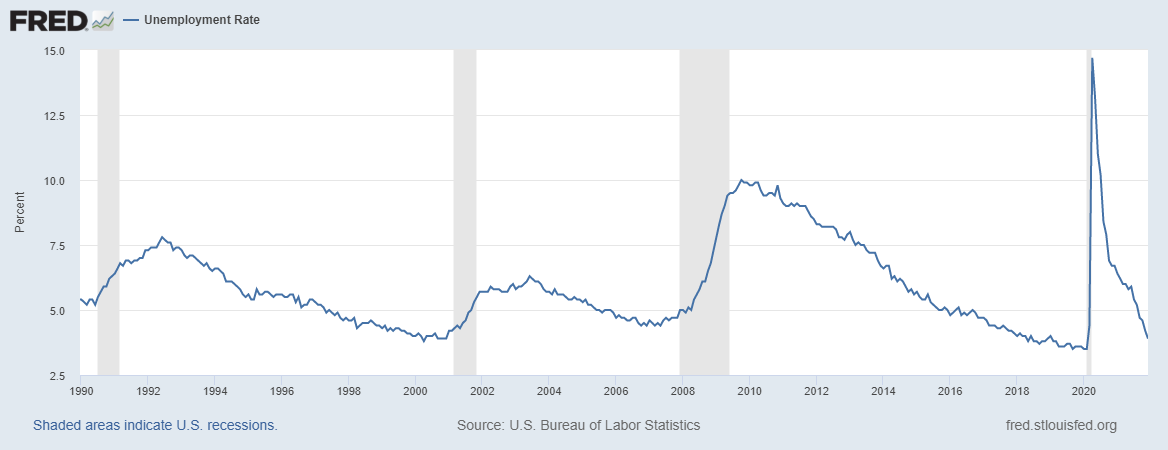

Inflation is sitting at 7.1% over the last year and the Fed is beginning to raise rates this March.

A quick recap on how we got here…dun dun dun…COVID.

The market took a tumble in March of 2020. If you want a blow-by-blow recap I wrote one here: COVID Crash recap

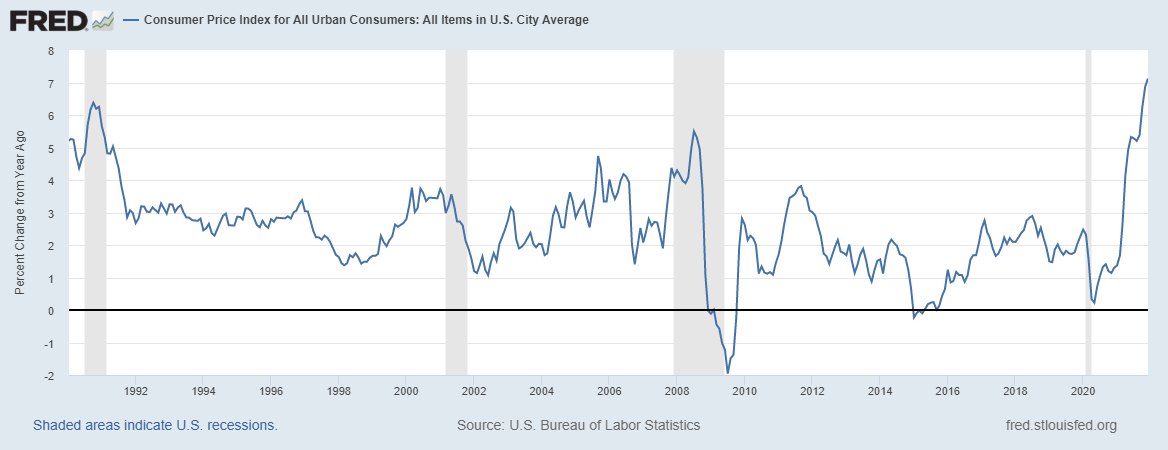

The Fed has a dual mandate from Congress: keep unemployment low and control inflation. In theory, it works like a seesaw. As unemployment goes down the economy should be growing faster, which theoretically causes inflation. So, the Fed will raise rates and hopefully glide the economy slower without causing a recession.

During the COVID Crash, the Fed pumped the economy full of liquidity and support. This is called monetary policy. On top of that, there was fiscal support from Congress in the form of the CARES Act. That sent out the stimulus checks and such.

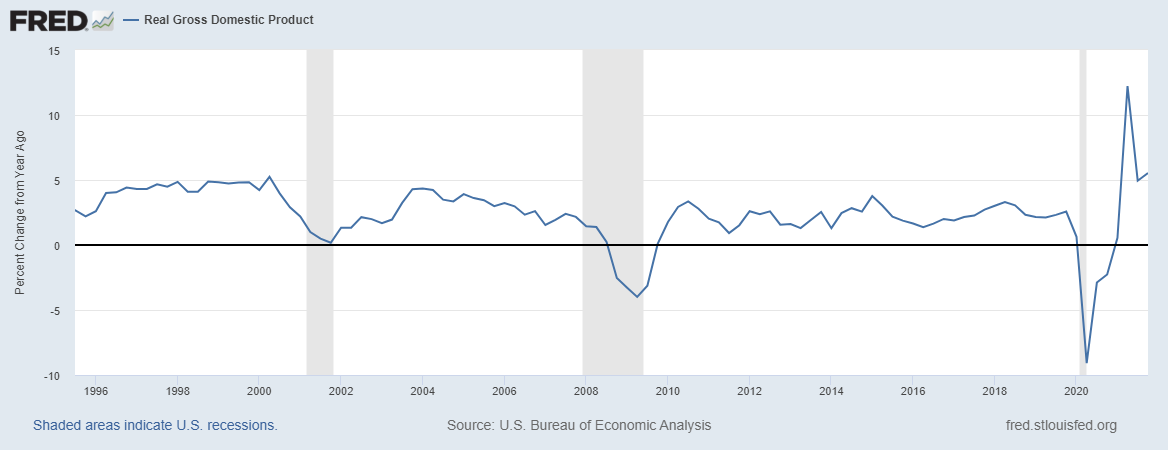

Welp, the combination of monetary and fiscal support all worked extremely well; GDP and unemployment came snapping back:

But, inflation is way above the Fed’s unofficial 2% target:

How did this happen?

Consumer spending changed as seen below. The red line is consumer expenditures on services (eating out, hotels, and such). Usually, service expenditures in prior recessions hold steady. You can see this in the left-shaded grey area, which is the 2008 Financial Crisis. With everyone on lockdown that obviously stopped and is just now getting back to pre-COVID levels. The blue line is consumer expenditures on goods. And that went BANANAS:

So if you have people buying record numbers of goods, long supply routes to get those products where they need to be, and production is hampered for a variety of reasons, then those prices would probably go up, right?

That’s what happened. A few sectors that were disproportionately affected drove the large inflation numbers. About to get a little geeky here…from Matt Klein at The Overshoot has a great visual:

Three components of inflation contributed to 70% of the increase:

Motor Vehicles comprised 37%

Energy (oil) made up 27%

Groceries (mainly meat) made up the rest

That is not normal and what someone who is trying to impress a date would call idiosyncratic, which I think means just unique and/or unlikely to see again.

Now Enter The Fed

It sees all of this and currently has short-term interest rates at 0%. That is not normal for money to be essentially “free”.

The Fed was hesitant to raise rates immediately because, yes, unemployment has recovered, but we are still way below pre-employment levels (as measured by labor participation). What they are worried about now is waiting too long to raise rates and inflation becoming a self-reinforcing prophecy. If everyone thinks inflation will continue, well, then it encourages a cycle of inflation-like behavior.

So, they have communicated that in March they will start raising rates. That will make “money” more expensive, which should in theory start slowing the economy down from being extremely hot and bring inflation down. They’re hoping to create a Goldilocks scenario: not too hot, not too cold, but juuuuuuust right.

The Next Big Problem

If I were a betting man, then I’d bet vehicles, energy, and food inflation begins to dissipate. And inflation will be lower than 7% this time next year.

BUT!

One of the largest sectors in CPI is the estimated cost for shelter. It’s complicated how this is calculated, but it's a guess on people’s rent. However, rent increases have been suppressed because of the rent moratoriums. What happens with that?! I’m no expert there. My best flippant guess is that this time next year inflation is at 4-5%. Probably a little too hot, but hopefully just right for the economy to keep growing. Can’t wait to find out why I’m so wrong.

“This Is All So-And-So’s Fault”

It’s easy to poke holes in the policy choices made during COVID (remember the monetary and fiscal we talked about earlier). But the big thing to point out about our inflation issues is that it's not just happening in the US. We supported the consumer directly more than other countries as seen here:

The US had the highest direct support (red bar for spending) of developed economies. Other countries chose loans and guarantees, which doesn’t translate to money being put directly into the system like the US’s choice.

Despite the different choices inflation is running hot almost everywhere:

UK highest inflation since 19921

Germany highest inflation since 19932

South Korea highest inflation in a decade3

You get the idea.

Seems there is a multitude of reasons for inflation: supply chain, COVID disruptions, changes in consumer spending, etc. Easier to throw the blame on one specific argument/person rather than diving into a complicated area.

Reach out with questions and feedback!

https://www.cnbc.com/2022/01/19/uk-inflation-rate-soars-to-30-year-high-as-cost-pressures-continue.html

https://www.destatis.de/EN/Themes/Economy/Prices/Consumer-Price-Index/_node.html

https://www.bbc.com/news/business-59990470#:~:text=Surging%20inflation%20has%20ramped%20up,than%20projected%20by%20the%20BOK.